At Bahrain Credit, you define your business purpose, we help you achieve it.

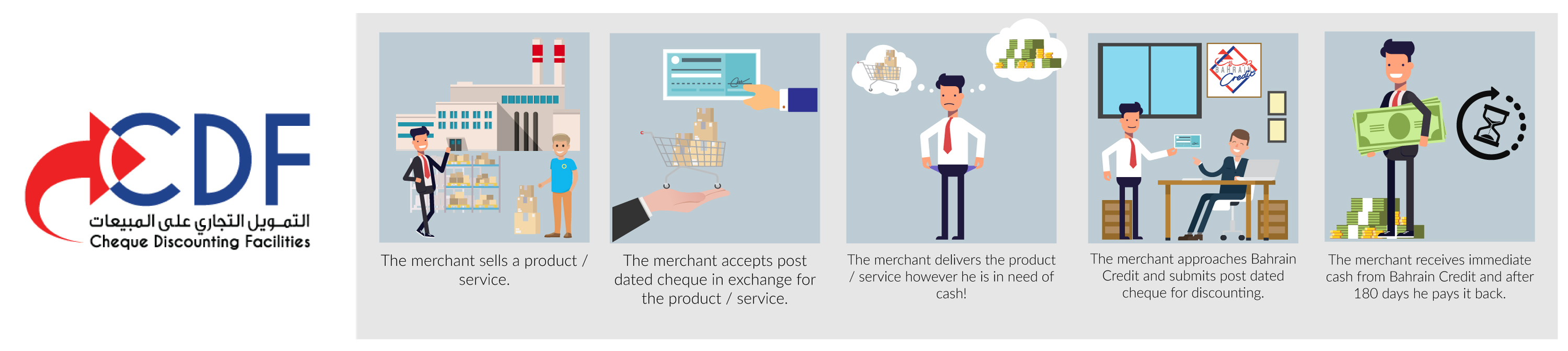

Our Cheque Discounting Facilities (CDF) and Invoice Discounting Facilities (IDF) are a flexible funding option designed to support small and medium enterprises (SMEs) by offering immediate liquidity access through discounting their clients’ post-dated cheques. This financial solution ensures a continuous flow of SMEs' working capital, expand your trading business, and enhance SMEs' business growth.

Features*:

Features of our CDF and IDF product include:

-

Financial solution for small and medium size companies

-

Precision liquidity (we provide liquidity to your business at the right time)

-

Working capital funding

-

Cost effective, short term lending

-

Direct funding, no need for bank accounts

-

Efficient and quick access to liquidity

-

Easy and simple documentation

-

Facilitate bigger and wider trading cycles

-

Fast and flexible approval

-

Competitve funding services.

Required Documents:

Minimum Financial requirements:

- For individual establishments: 3 years inhouse financials if not available, 2 years Bank statement

- For WLL: 3 years audited financials.

KYC Requirements:

- Company Profile

- Copy of valid CR/ license

- owners/shareholders valid ID’s

- WLL Documents: (memorandum/ article of association and any amendments, board resolution)

- Consents to generate Benefit CRB (for Company and joint/guarantors)

Disclaimer: BCFC may request additional information based on the company type

For enquiries contact:

* All features are subject to terms & conditions.

Follow us: